Using a Trend Correctly when Trading

Close your eyes and recall when you first started trading.

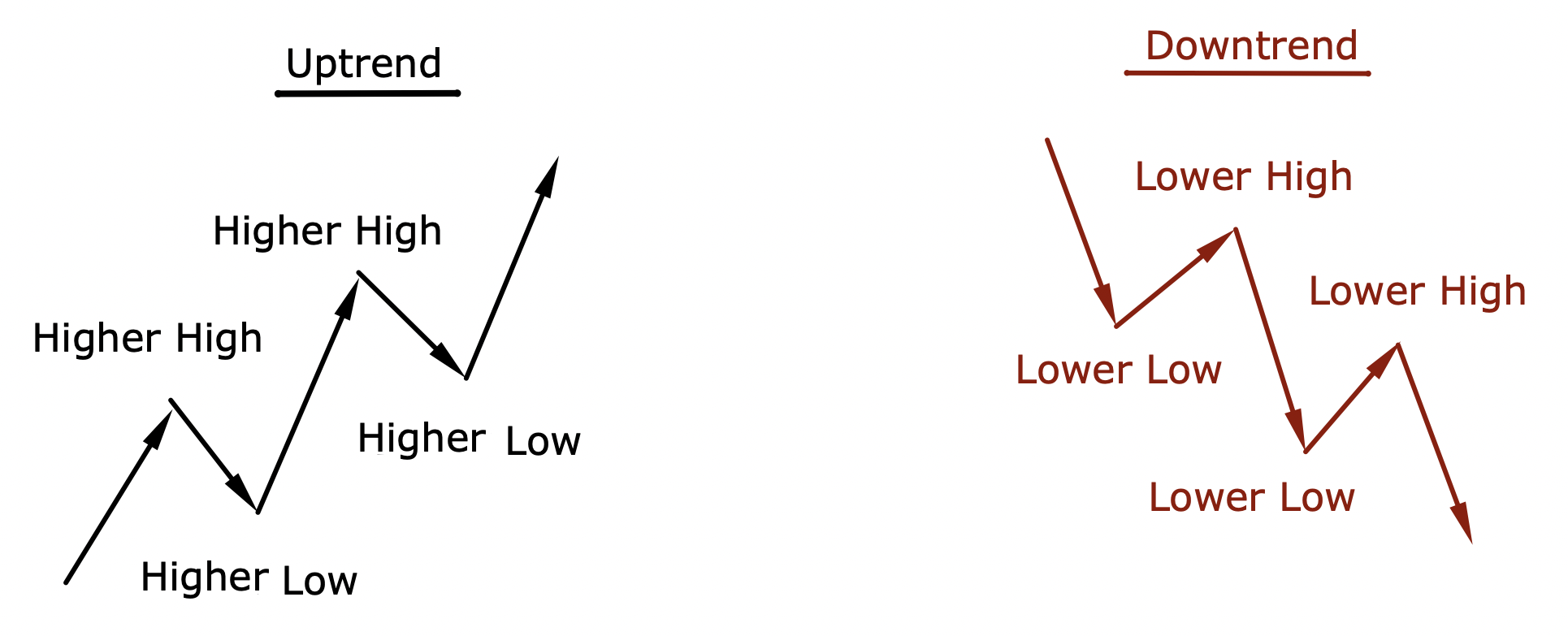

I'm not trying to make any assumptions here (pretty sure I just did), but this image probably popped up as one of the first strategy/concept you learned.

Buying the Higher Lows and Selling the Lower Highs.

Theoretically, it's the easiest strategy to begin with. It's a no brainer to trade with the trend, because the trend is your friend. Right?

Right?

No...

No, at least not based on my trading account when I first tried this years ago...

The overall strategy/concept is fine, trading with the trend. But you cannot keep buying every dip and selling every rally you see. There's more than that to it. And that is to recognize which trend is not your friend anymore.

Here's the thing, to have a higher success rate when trading with the trend, there are 2 extremely important keys you want to consider before joining any trend:

1. Health

2. Momentum

Let's dive deeper into this topic.

Here's What You Will Take Away

1. Health Of A Trend

2. Momentum Of A Trend

3. How To Apply These To Your Trading

4. Conclusion

1. Health Of A Trend

First piece of the puzzle here, the Health.

Now, this may sound like an odd thing to hear, the 'Health'?

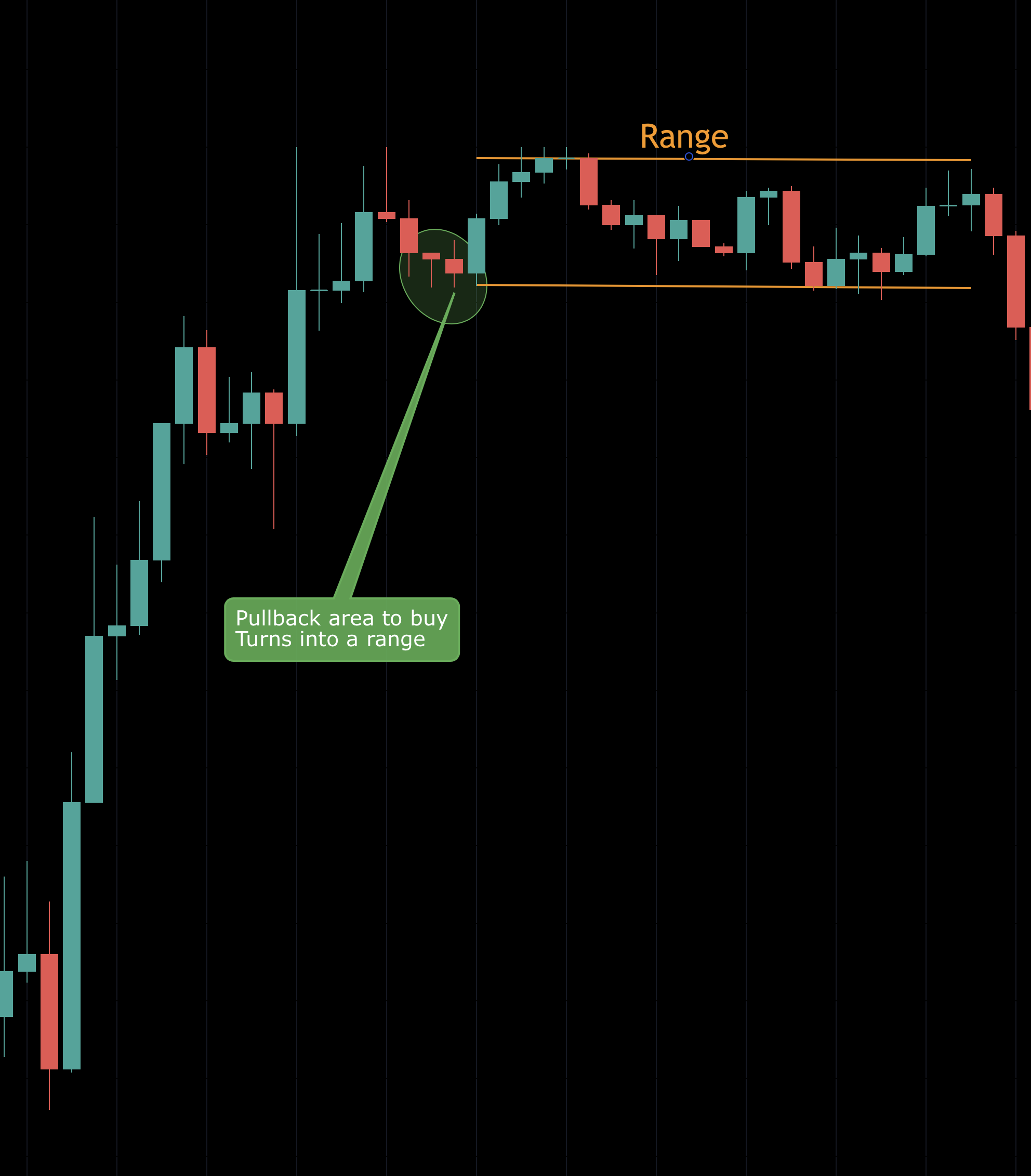

Yes, the Health. before considering trading on any trend, you'll have to make sure that it's healthy to begin with. Otherwise, the higher low you may be buying, may just turn into a range without giving you any higher high.

To have higher odds of buying a low that becomes a higher high. You want to make sure the trend prior to it is Healthy.

And the way to know that is to measure the pushes and look at the distance of each push.

Here's an example of that:

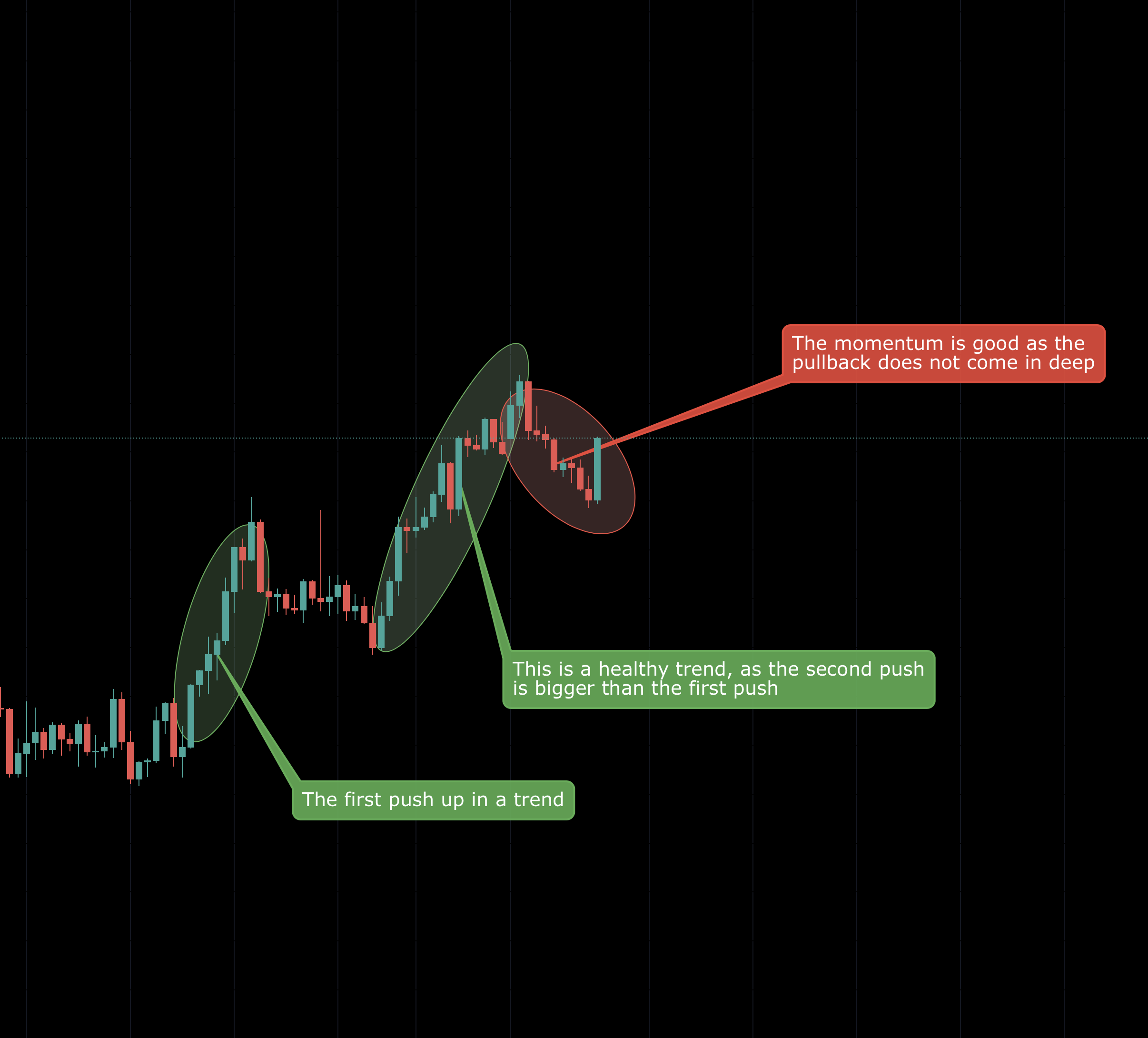

Notice the second push here covers more distance than the first push? This is a good sign, showing that the trend is still very healthy and has good odds of making higher highs after a higher low:

The flip side is true as well, you do not want to sell a lower high when the down trend pushes before it is unhealthy:

You want to sell a lower high when the down trend (before it) is healthy:

2. Momentum Of A Trend

Second piece of the puzzle, the Momentum of the trend.

Momentum is a tool that's supposed to be used alongside the Health that I wrote about earlier.

The same thing applies here, the stronger the Momentum, the more likely that the trend will continue. And here's how we use this with the Health:

As you see, to understand the momentum, we need to look at the pullback after each push. And here, the pullbacks are actually getting smaller.

This is a major sign showing that the momentum is clearly present and it's still a strong trend.

On the flip side, here's an example of a down trend with its momentum slowing down:

Now here, you do not want to join the sell side, because you can clearly see that the momentum is dying.

This trend, may not be such a good friend anymore...

3. How to Apply these to your trading

To make things simple, you just need to assess 2 criteria before joining a trend.

Yes, you've guessed it:

1. Health

2. Momentum

The second you see that the Health and Momentum is not present anymore, you want to stop trying to trade the trend, because you may find yourself stuck for a while before the trend resumes.

So, let me give you a text book example for a healthy trend which you want to be on:

Look at the Health and Momentum of the previous push:

Then,

Look at the Health and Momentum of the following push:

This now then is a green light for you to join the trend. You will likely see further follow through.

All you need to do now is to drop down to your lower timeframe to gauge the momentum of the pullback to look for your entries as taught in the Mastering Price Action 2.0 Progam.

Conclusion

I wanted to make this a short and simple blog to get the main message across.

'Not all trends are your friend'

Understand the Health and Momentum is key to successful trend trading.

Again, we are not going into the details of the precise entries here as those are topics which can be covered in other blogs/webinars. But I'm sure you guys who have the Mastering Price Action 2.0 Progam would know what to do after identifying a trend worthy of being your 'friend' :)

With Pip Love,

Lucas at Urban Forex